"Figure Out How the FICO Credit Score is Calculated And Use That Towards Your Advantage To Improve Your Credit Score or Simply To Keep It Up!"

Ways To Improve Your Credit Score: Part 3 of 4

By knowing what’s factored into your FICO score, you are another step closer to knowing how to improve your credit score. And at the very least it’ll help you take measures to make sure it doesn’t get lower.

The basic formula provided by FICO is broken down into five parts and how much they weigh towards your score:

- Payment History – 35%

- Credit Utilization – 30%

- Length of Credit History – 15%

- Types of Credit Used – 10%

- Recent Search for Credit – 10%

Keep in mind the range of the FICO score is 300 to 850. This means you can’t get a FICO score lower than a 300 and the Read Part 4: Ways to Improve Your Credit Score

Credit Score Meaning

"Credit Scores Go Beyond Banks and Loans, They Affect Many Parts of Your Life. Learn What A Credit Score Means"

Ways To Improve Your Credit Score: Part 2 of 4

« Read Part 1: Are you trying to figure out what your credit score means to you? Are you wondering if your credit score can help you:

- Receive a better job offer

- Qualify for a nicer credit card

- Get a better insurance rate

- Obtain a better rate on your loan

Wondering if getting your score gives you any of these benefits or at least a small step towards being financially smarter? Do any of these questions sound familiar? If so, then this article is for YOU! And you should scroll down and read this entire article.

It’s Smart to Be in the Know

There’s really no other way to say it. People who have their financial ducks in a row do MUCH better than those who don’t. Even people who have worse credit than the ones with good credit! Confused? Let me explain.

The numbers we usually have on our minds are our age, cholesterol level, salary, or even sports scores. The simple truth is that your credit score is probably the most important set of numbers attached to your identity that you don’t know, BUT SHOULD.

Though a bit strange, the simple truth is that your credit score can affect:

- The educational options available to you and your family

- The neighborhood you live in

- The life insurance you own

- The job you are offered

You should know your credit score BEFORE you apply for a loan or make a major financial decision because it will improve your options.

Not knowing your score leaves you vulnerable. This can lead you to be a victim like so many we’ve read about in the housing, banking and job market fall out of the past few years.

Lessons Learned

Yes, we run into hard times and mistakes are made. We have difficulty paying back our credit cards or loans at times. It’s not unusual and it can happen to anyone. But being PREPARED and making sure you are RESPONSIBLE enough to check and monitor your credit score, is a decision that each of us has instant control over.

You need to be proactive, smart, and savvy with your credit in order to guarantee you get the greatest opportunities available and don’t become a victim!

Stay tuned for our next major artilce that discusses the FICO Credit Score Breakdown. Coming soon!

Read Part 3: Ways to Improve Your Credit Score

Ways To Improve Your Credit Score

Learn What A Credit Score Means To You, How A Credit Score is Calculated, and Some Quick Tips on Improving Your Credit Score!

With the recent financial hardships millions of Americans are facing, it’s more important than ever to make sure you’re protecting and taking steps to improve your credit score.

Through this short series of articles, you will learn:

- What the credit score meaning is and its affects on your life – Yes, your life! It’s amazing how much your credit score can affect where you live, your education options, and even which job you get. More people should be aware of this. Think of it as being a part of the game of life – your real life.

- The credit score breakdown in detail – The first step to winning in the credit score game is to understand the rules. I will be discussing how the most commonly used credit score, the FICO Score, is broken down and calculated. Please note that since this is FICO’s bread and butter, their complete formula isn’t public. But the information provided does come through some sound research and are based on reasonable assumptions.

- 5 best ways to raise credit score – Based on what is known about the FICO Credit Score formula, we can clearly figure out 5 ways to raise your score or keep it up. These tips will help you stay on top of the credit score game and make sure you continually optimize it.

Hopefully these articles will expose you to new information and help you find additional ways to improve your credit score. Please feel free to contact us with your feedback and questions.

Read Part 3: Ways to Improve Your Credit Score

10,000+ Baby Boomer Retiring in 2011 Problems

So CNN has just reported that there will be ten thousand (10,000) plus workers ready to file for retirement. Unfortunately, a majority of them are not prepared, mainly due to not having enough saved. Now, it’s not completely their fault, as our economy has hit some rough spots and their retirement funds didn’t profit as much as projected. However, I still can’t help but think it was also a lack of financial management education that held a majority of the baby boomers back.

Back in the day, people weren’t as aware of how the economy functioned. They probably weren’t aware of the idea of inflation or how to leverage compound interest. I also believe most baby boomers are more credit card adverse. If they were provided the right financial education upfront, then it would certainly lessen the stress the government/public is having now on how to handle the social security benefits.

I have already accepted the fact that when I retire, social security will be a memory of the past. It’s an ideal program in theory, but there are just so many permutations you can take into consideration when coming up with this program. And if history is any indicator, we know that grand ideal solutions never get executed as well as originally thought. This why I am such a huge proponent of teaching kids about money and financial responsibility.

Don’t Blame Credit Cards

It’s noticeable that credit cards have gotten a very bad reputation over time. Credit cards are typically associated with negative connotations, such as high debt, bankruptcy, and simply fear. It’s time to stop misdirecting the blame of these negative attributes to an inanimate object and start looking at ourselves, the consumers. With proper money management education, we can curb a lot of household financial distress.

It is said that the average credit card debt per credit card holder is figured to be about $8,000. Of course, this number is skewed because a majority of consumers could have zero credit card debt, while the remaining have massive debt. It’s figures like these that have driven people away from leveraging their credit cards more often. However, the numbers themselves do not speak the whole truth.

There is a difference between good debt and bad debt. Good debt is typically associated with investments that will help generate additional value in the long run (e.g. education, office equipment, advertising, etc). Bad debt is something we are more commonly aware of, which are purchases that are not necessary for survival nor generates/appreciates in value over time. These are also referred to as luxury items. Though the amount of credit card debt may be massive on one end of the spectrum, who is to say that it is not being used for good debt?

Aside from the “high average debt”, credit card companies are also perceived as vultures for targeting unassuming consumers. And though, it’s true, there are some companies that prey on consumers lack of due diligence (e.g. the Kardashian Kard), most do not. They only provide the applicant with what they calculate he/she can handle, especially since financial institutions are so adverse to extending credit nowadays. Just because financial institutions distribute the cards does not mean we should be condemning them either. It’s up to the consumer to ensure they understand the terms they are getting themselves into and the best option for them.

The real concern of credit card usage lays with the consumers that are not living within their means and are over consuming luxury items. Their finger should point to themselves for getting placed in this predicament. The question is then, how do we solve this? The answer: provide better and earlier education in financial/money management. Without proper education, the amount of bad debt consumers incur will continually grow, no accountability for their own actions will be taken, and the economy will be hurt even more.

The initiative to solve this problem is underway, such as the Ariel Elementary Community Academy mentioned in the article,teaching kids about money. And other resources, provided by CreditCard.com, allow consumers to determine which cards are available for them and and list of their terms and benefits.

As some of you may have noticed, a list of examples for luxury items was not provided, because there’s always a way to rationalize how it can be considered an investment. But let’s be honest with ourselves, we know what we need to survive, what truly generates value, and what we simply want because of the “cool factor”.

8 Reasons Credit Cards Are Better Than Debit Cards

Based on a recent article from the National Retail Federation, consumers will be relying less on credit cards this holiday season. In fact, it’ll be the lowest since 2002. People are making this decision because they want to actively budget they’re spending on gifts. I believe this a strategy that works well, but if you can control your spending WHILE using your credit card, then you’re getting the best of both worlds.

In light of the holiday season, I’ll give you my Top 8 reasons of why using a Credit Card is better than a Debit Card:

- Credit cards provide better security. If you have any charge disputes on your debit card because your card got stolen, then the bank will not release your money until it has been cleared. That means you can be out of hundreds or thousands of dollars, when it wasn’t even your fault.

- Accumulate Reward Points. More credit cards than debit cards allow you to accumulate points towards reward items (e.g. travel, electronics, even cash)

- Build your credit. As always, building a good credit history is extremely important and only a very few debit cards can do this.

- Warranty coverage. Surprisingly, most credit cards offer a special warranty on items you purchase with it. Perfect for when your gift is broken within a year. I was surprised to find out how many of my own cards offered this benefit. You should call up your credit card company and see if you’re covered as well.

- Stress-Free Authorization Holds. You’ll notice when you check into a hotel, they typically have signs telling you that they will place a temporary charge on your debit card. This charge is used to protect the hotel from delinquent guests, which is fair. However, this charge will remain on hold for days after you’ve checked out. This means you’re have less cash on hand.

- Cheaper to rent a car. Perhaps you’re visiting family outside your hometown and need to rent a car. If you try to rent with a debit card, they will require that you use pay the daily insurance coverage.

- Price Protection. Another surprise is that some credit cards also offer price protection on the items you purchase. This means if you purchased a product and the price drops within a certain time period (usually 30 days), the credit card company will match the new price.

- Various Additional Perks. Roadside assistance, lost luggage coverage, are just to name a couple and when the snow falls or you have a valuable gift in your luggage, these will come in very handy.

You may wonder why I left out “overdraft fees”. This was a major advantage of credit cards over debit cards. However, with the new federal law passed in July 2010, it prevents banks from charging you an overdraft fee and simply decline purchases if you don’t have enough. You can get around this by providing your bank the permission to withdraw from another account, but my personal opinion is to not opt-in and simply let charges get declined.

Another great perk of a credit card versus a debit card, is that if you get a 0% APR or low interest credit card, it’s essentially free money.

How to Activate Chase Quick Deposit for iPhone

As a follow up to my article, “Chase Quick Deposit on their iPhone App“, I wanted to walk people through the steps on how to activate your Chase Quick Deposit feature. Here are the seven (7) easy steps:

- On your iPhone, open the Chase app.

- Press the “Deposits” button.

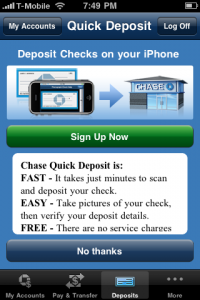

- A welcome screen appears.

- Press the “Sign Up Now” button.

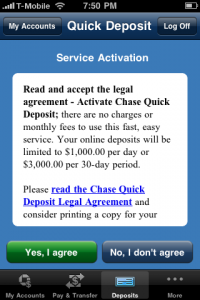

- A Service Activation notice will appear.

- If you agree to the terms then press “Yes, I agree“.

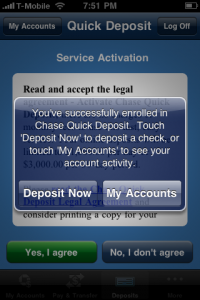

- Lastly, a message will appear stating you have successfully enrolled.

Visual Walk Through of the Chase Quick Deposit activation:

Don’t Be Lazy When It Comes to Money: Use A Manual Ledger

If you’re like me, you find it really convenient that your credit card or banking institution provides you with a list of your most recent transactions when you log into your online account. It really simplifies the book keeping process and that’s great. Unfortunately, with simplicity comes laziness and with laziness comes mistakes/unwelcomed surprises. I have to admit, I have fallen victim to this.

This past month, I have been going out more often with friends for birthdays, dinners, movies, etc. This leads to me placing charges to to my credit card. I usually check my balance once a week to make everything is in order, but with multiple things going on and again, laziness, I skipped a few weeks. To my unwelcomed surprise, I spent a lot more than I have in a long while. Luckily, I can handle it, but it blew out my budget for the month.

What could I have done to avoid this? Well, I guess I could have checked my online balance more often, but not all transactions appear immediately. And even if they do, they typically don’t include the additional tip you’ve added to the bill. Going out to eat numerous times can really cause your total debt to be offset by a lot. My solution is to keep a simple ledger going forward. It doesn’t have to be anything fancy whatsoever, just follow these three easy steps:

- Create a new spreadsheet

- Create four (4) columns: Transaction Date, Vendor, Card, and Amount:

- Transaction Date – the date you made the purchase or deposited money

- Vendor – the place you made your purchase or return

- Card – in case you have multiple cards, you can keep track of which one your spending with

- Amount – the cost of the transaction

- Enter all your transactions each night through the receipts you collect

This is a tactic I used to curb my spending after college as well. It worked wonders because it gave me a real time tally of how much I was spending and how much I truly had left in my accounts. It’s also the idea of associating your purchase with additional labor and helps with memorization. What does it help you remember? THAT YOU KEEP SPENDING MONEY THAT SHOULD BE SAVED!

Chase Quick Deposit on their iPhone App

Follow this link to find detailed steps on How to Activate Chase Quick Deposit for iPhone.

After my iPhone App updates are completed, I like to go into each newly updated app and figure out how they were “improved”. From my earlier experiences, it usually just turns out the apps now contained more advertising.

After my iPhone App updates are completed, I like to go into each newly updated app and figure out how they were “improved”. From my earlier experiences, it usually just turns out the apps now contained more advertising.

However, when I opened up the new Chase iPhone App, I noticed a new icon on the bottom navigation marked as “Deposits”. Initially I thought, what a useless add-on. What? It’s going to tell me what my recent deposits were? I mean, sure, I guess some people would find it useful. So I just pressed the new icon and was blown away.

This wasn’t a feature that tells you what your most recent deposits were, it’s a feature that actually allows you TO MAKE DEPOSITS! I was completely blown away. Is this for real? I haven’t used it myself yet, but it seems like you simply need to take a photo of the front and back (ensure you sign it too) of the check(s) you’re depositing (up to a total of $1000 per day or $3,000 a week), press a couple of buttons, and you’re all set. I believe I have a $50 check laying around here somewhere and I’ll follow up with how smoothly or rough everything goes.

On another note, the Chase iPhone App has also activated a new feature called Person-to-Person QuickPay. Once you activate this feature through a regular computer, you can then have the option of sending/request payments to/from anyone by simply entering their E-mail address. Similar to how PayPal does it’s payments. That’s pretty awesome.

I’m amazed by the innovation that Chase has brought into the playing field of financial services and I’m sure it’s hard for people not to be impressed. Understandably, there are concerns of authenticity and validation of each check being deposited, but I’m sure Chase will address those security concerns.

Update (2010-07-05) Just completed my first Chase Quick Deposit and everything went pretty smoothly, even while using EDGE. I personally chose to retake the photos a couple of times, just to make sure my first deposit goes well. If any hiccups occur, I’ll be sure to update this post.

How Credit Card Interest is Calculated

There is no simple way to calculate interest on credit cards. There are different values that come into play:

- Outstanding balance from the month before

- Annual Percentage Rate of your credit card

- Number of days in a month your credit card is calculated over

- Number of days in a year your credit card is calculated over

- Your Monthly Payment amount

For the calculations below, I’m just going to take a snapshot in time, so that it doesn’t take into account your monthly payments and compound interest. Essentially, I’m trying to give you a simpler view so that it’ll be easier to digest how much money you will be burning on interest on a daily, monthly, and annual basis.

The below examples will use the following values:

- Annual Percentage Rate = 10%

- Outstanding Balance = $5000

- Days per Month = 30

- Days per Year = 365

Formula to calculate daily credit card interest accrued:

- ((Annual Percentage Rate/100)/Days per Year) * Outstanding Balance = Daily Interest

- Example: ((10/100)/365) * 5000 = $1.37

Formula to calculate monthly credit card interest accrued:

- ((Annual Percentage Rate/100)/Days per Year) * Outstanding Balance * Days per Month= Monthly Interest

- Example: ((10/100)/365) * 5000 * 30 = $41.10

Formula to calculate annual credit card interest accrued:

- Outstanding Balance * (Annual Percentage Rate/100) = Annual Interest

- Example: 5000 * (10/100) = $500.00

What Are The Benefits to Calculating Your Daily Interest Rate?

After I created the “Calculate Your Daily, Monthly, and Annual Credit Card Interest” page, I was asked numerous times, why did you specifically decide to create that tool and what purpose does it serve? Well, I guess my brief intro on the homepage was a bit too brief. Let me elaborate.

Around the time I created that automated form, I was actually trying to make the decision of whether or not it’d be worth my effort to transfer my credit card debt into another credit card. I had multiple 0% balance transfer offers on existing cards, but knew better than to think it was a no-brainer decision, since there’s always a transfer fee associated with them.

The first step I took was to calculate how much interest I was losing per month. The idea was that the one time balance transfer fee may equate to be about three months worth of interest, in which case I could potentially pay off within two months. If that were the situation, then I would be wasting time calling up their customer service to perform the transfer. Not to mention, it’s just a dumb decision to pay more in the long run.

Once I got the formula to calculate the monthly interest rate and determined it was a good idea to perform the transfer, it dawned on me that it’d be extremely interesting to figure out how much I was “spending” by carrying this balance for so long. Of course my balance fluctuated throughout the months and years, but I just had to simplify my decision making process by fixing the balance to the amount at the time. What I discovered was pretty eye opening the moment I saw it.

I believe my daily interest came out to be about $1.25, that like one item from the McDonald’s Dollar Menu (plus tax). But, I haven’t been eating at McDonald’s and a side salad sounded pretty good at the time. Then, I thought, what if I escalated the calculation to a week? It came out to be $8.75. That equated to about 3 gallons of gas for my car. And what the heck? I’m always filling up my tank. That extra money would come in really handy!

Essentially, it put the money I was spending on credit card interest into perspective. Seemingly small amounts really add up and I couldn’t believe it. At that point, I made it a goal of mine to erase my credit card debt as soon as possible. So, my purpose of the form is mainly to provide people, in a similar situation that I was in, some perspective. It’s extremely important to manage your money (especially for kids) and figure do what you can to lower/extinguish your credit card debt.

I truly hope some people out there who have used my form realized the same lesson I did. For those who are severe bad credit situations, I recommend determining and monitoring your credit score first to determine how deep you’re in it and then just work your way up.

How To Build Credit With The Public Savings Bank Secured Visa

I was provided the following article for the Public Savings Bank Secured Visa. In a nutshell, this card allows you to create good credit history while removing the risk of missing a payment, which in turn will improve your credit history. Here are the simple steps they provide on their site:

- You deposit a minimum of $300 into a Public Savings Bank FDIC insured deposit account.

- You can then make purchases with your card up to the amount you have in your security deposit account.

- You must pay at least the minimum payment before the due date each month. Your security deposit does not cover minimum payments.

- Your payments are reported to all 3 major credit bureaus (TransUnion, Experian, Equifax) so you can begin to establish your credit immediately.

For people with no credit or those who have experienced a negative credit event, such as divorce or foreclosure, establishing credit history can be difficult. Without proper credit, everything from a car loan to an apartment or even a job can be denied.

Prepaid cards are one way to manage daily expenses. However, prepaid cards simply provide access to your own money, not credit from a lender. Prepaid cards do not report to credit bureaus and do not help re-establish credit history. Individuals need to demonstrate on-time monthly payments on a credit card in order to rebuild credit history that’s so important.

How can someone who is denied a credit card rebuild their credit?

Well, one option is the Public Savings Bank Secured Visa. It offers people with low credit or no credit the ability to re-establish their credit history and work towards improving their credit score. Individuals deposit money into an FDIC-insured account that acts as a security deposit. They can then make purchases anywhere Visa is accepted or take cash advances up to the deposited credit line amount, currently between $300-$2000. Payments are reported to all three major credit bureaus (TransUnion, Experian and Equifax) so customers can begin to establish credit immediately.

The Public Savings Bank Secured Visa does not require a credit check or even a checking account to apply. Customers can fund their account via Western Union, ACH, wire transfer, check or money order. The card has no annual or monthly fees, and offers 0% APR for 6 months. Rush shipping is available so customers can begin using their card just days after funding their account.

Building good credit is critical at a time when credit is getting harder to obtain. This card allows the customer to build good credit while enjoying all the benefits of a Visa card at very favorable terms.

You can apply for the Public Savings Vank Secured Visa at www.publicbankcard.com and be approved within only a few hours.