Definition of Credit Card

A credit card is a widely used financial instrument that allows consumers to make purchases on credit. It is a physical card, typically made of plastic, issued by a financial institution or credit card company. The concept of credit cards has its roots in ancient times, where clay tablets were used as a form of credit. However, the modern credit card as we know it today emerged in the mid-20th century. The first charge card, known as the Diners’ Club card, was introduced in 1950 by Frank McNamara and Ralph Schneider. This card allowed cardholders to charge their meals at restaurants and pay the bill at a later date. It was the first step towards the widespread adoption of credit cards, and soon after, other companies like American Express and Bank of America’s BankAmericard (later renamed Visa) entered the credit card industry. The development of credit card technology, such as the magnetic strip, made transactions more secure and convenient. Today, credit cards are a common financial tool, offering benefits like rewards programs and contactless payments. However, it is important for cardholders to manage their credit card accounts responsibly to avoid falling into credit card debt and other poor practices.

Overview of Credit Card History

Credit cards have a rich and fascinating history that stretches back to ancient times. The concept of credit, or borrowing to make purchases, can be traced back to early civilizations such as the Sumerians who used clay tablets to record lending transactions.

However, it was not until the mid-20th century that credit cards as we know them today began to take shape. In 1950, Ralph Schneider and Frank McNamara introduced the first modern credit card through their company, Diners Club. This card allowed customers to charge their meals at select restaurants without needing to carry cash.

The development of revolving credit, where cardholders could carry a balance from month to month, came in 1958 with the introduction of BankAmericard by Bank of America. This paved the way for the credit card industry to flourish and revolutionize the way people made purchases.

Throughout the years, credit cards evolved with the advancements in credit card technology. The physical card itself transitioned from metal charge plates to plastic cards with magnetic strips, making transactions more convenient and secure.

In the modern era, credit cards have become an indispensable financial instrument used by millions of people worldwide. They offer a range of benefits, including credit card rewards and protection against fraudulent transactions. From contactless payments to virtual credit cards, the types of credit cards have expanded to meet the needs of consumers.

In conclusion, credit cards have come a long way from their ancient origins to become a cornerstone of the global economy. The introduction of Diners Club and the development of revolving credit by Bank of America were instrumental in shaping the credit card industry as we know it today. Through continuous innovation, credit cards have become an essential tool for financial transactions.

Pre-Modern Times

Pre-Modern Times: The concept of credit can be traced back to ancient civilizations such as the Sumerians who used clay tablets to record lending transactions. In these pre-modern times, borrowing and lending were common practices among individuals and merchants. However, there were no formal credit cards or systems in place to facilitate these transactions. Instead, credit was typically extended through personal relationships, with individuals giving each other “promissory notes” or other forms of written agreements to repay debts. This informal credit system gradually evolved over time, laying the foundation for the development of formal credit card systems in the future.

Ancient Method of Exchange

In ancient times, the method of exchange relied heavily on credit coins and charge plates. These unique forms of currency acted as a primitive credit system that allowed individuals to make purchases on credit until their resources, like crops, were harvested. It was similar to running a tab.

Credit coins were small metal discs that were imprinted with the buyer’s name and the amount of credit they were granted. These credits could then be used to make purchases at various merchants. Charge plates, on the other hand, were typically made of clay or metal and were used to record a buyer’s name and the amount they owed to a particular merchant.

As this credit system gained popularity, it expanded beyond individual buyers and sellers. Stores and hotels started issuing their own credit coins and charge plates, allowing customers to buy goods and services with the promise of payment at a later date.

The ancient method of exchange through credit coins and charge plates laid the foundation for the development of modern credit systems. It showcased the concept of extending credit to consumers and allowing them to make purchases based on trust and future payment. Without the innovation of these ancient credit systems, the modern credit card industry as we know it today may not have existed.

Charge Plates and Charge Coins

Charge plates and charge coins were early forms of credit cards that were used to transfer account information and make purchases. These objects were made of various materials, such as clay or metal, and came in different shapes and sizes.

Charge plates were typically made of clay or metal and were used to record a buyer’s name and the amount they owed to a particular merchant. These plates were then kept at the merchant’s establishment and would be updated with each transaction. When a customer made a purchase, their account information would be transferred to the charge plate, allowing them to buy goods and services with the promise of payment at a later date.

Charge coins, on the other hand, were small metal discs that were imprinted with the buyer’s name and the amount of credit they were granted. These coins acted as portable account information and could be used to make purchases at various merchants. Customers would present their charge coin at the time of purchase, and the merchant would record the transaction amount on the coin. The customer would settle their account later on by paying off the charge coin.

Both charge plates and charge coins revolutionized the way credit was handled in ancient times, enabling the transfer of account information and facilitating purchases without the need for immediate payment.

Modern Credit Card Beginnings

In the mid 20th century, the concept of the modern credit card began to take shape. It was during this time that advancements in technology and changes in consumer behavior set the stage for the development of the credit card as we know it today. One of the pivotal moments in the history of credit cards occurred in 1949 when Frank X. McNamara, together with his partners Ralph Schneider and Matty Simmons, introduced the Diners’ Club card. This was the first charge card that allowed its holders to make purchases at a variety of different establishments. While not a true credit card in the sense that it allowed for the accumulation of debt over time, it paved the way for the development of the credit card industry and laid the foundation for the convenience and accessibility that credit cards offer today.

Ralph Schneider and the Bankcard Movement

Ralph Schneider played a significant role in the Bankcard Movement, which revolutionized the credit card industry. In the 1950s, Schneider co-founded the Diners’ Club and introduced the concept of the charge card. However, it was his creation of the BankAmericard that truly transformed the credit card landscape.

The BankAmericard, launched in the late 1950s, offered revolving credit, allowing cardholders to carry a balance and make minimum payments. This innovative feature gave consumers greater financial flexibility and paved the way for the modern credit card.

Schneider’s BankAmericard also introduced other key features that set the stage for credit cards as we know them today. It was a physical card made of cardboard, which was a departure from previous charge plates. The card featured a magnetic strip that stored cardholder information, improving convenience and security. Additionally, the BankAmericard was the first credit card to introduce mass mailing campaigns to attract new customers.

Due to its convenience and growing popularity, the BankAmericard quickly gained momentum, leading to its transformation into the first licensed general-purpose credit card. In 1976, the BankAmericard was rebranded as Visa, a name recognized worldwide.

Ralph Schneider’s vision and the Bankcard Movement greatly contributed to the development of credit cards, shaping the industry and paving the way for the widespread adoption of this financial instrument.

Department Stores Offer Charge Cards

Department stores have played a significant role in the history of credit cards, as they were among the first to offer charge cards to customers. These cards provided a convenient way for shoppers to make purchases and pay off their balances over time.

Department stores recognized the potential of offering their own charge cards as a means of attracting customer loyalty and increasing sales. By providing customers with the ability to make purchases on credit and pay later, these stores encouraged shoppers to spend more and visit more frequently. This strategy proved to be highly effective, leading to a substantial increase in sales for department stores.

Sears, a prominent department store, was one of the pioneers in this area. In 1934, Sears introduced their own charge card, which allowed customers to buy items on credit, giving birth to the Sears Charge Plate. This innovative approach not only increased sales for Sears but also fostered customer loyalty, as shoppers were encouraged to return to Sears for their future purchases.

Another notable example is Bloomingdale’s, a luxury department store. In 1949, Bloomingdale’s launched their charge card, which offered exclusive benefits such as discounts and special promotions for cardholders. This further incentivized customers to shop at Bloomingdale’s, promoting both customer loyalty and increased sales.

The introduction of charge cards by department stores revolutionized the retail industry, providing consumers with a convenient and flexible payment option. This innovative approach by stores like Sears and Bloomingdale’s not only boosted sales but also paved the way for the modern credit card industry.

Oil Companies Introduce Plastic Cards

In the history of credit cards, oil companies played a significant role in introducing plastic cards as a form of credit. Prior to the emergence of plastic cards, consumers relied on charge plates or paper-based credit systems. However, in the mid-20th century, oil companies recognized the potential of utilizing plastic cards for credit transactions.

Oil companies like Shell and Mobil began issuing plastic cards to their customers, allowing them to make purchases on credit at their gas stations. These plastic cards acted as a convenient form of payment, eliminating the need for cash and providing consumers with the flexibility to pay off their balances at a later date.

The introduction of plastic cards by oil companies significantly expanded the accessibility and convenience of credit for consumers. Unlike department store charge cards that were limited to specific stores, oil company cards could be used at multiple gas stations and even some affiliated retailers. This expansion in acceptance locations made credit more accessible to a wider range of consumers.

Furthermore, plastic cards offered greater durability compared to their paper counterparts, making them more practical for everyday use. The introduction of plastic cards by oil companies revolutionized the credit card industry and paved the way for the modern credit card technology we have today.

Overall, the initiation of plastic cards by oil companies enhanced the accessibility and convenience of credit for consumers, helping to shape the credit card industry into what it is today.

American Express Introduces the First True Credit Card

American Express holds a significant place in the history of credit cards, as it introduced the first true credit card in 1958. Prior to this, other credit cards were simply charge cards that required consumers to pay off their balances in full each month. American Express changed the game by introducing a charge card that allowed customers to pay their bill in monthly installments, in exchange for an annual fee.

This innovation by American Express was groundbreaking and set the stage for the development of the modern credit card industry. It provided customers with the convenience and flexibility of making purchases on credit and paying them off over time.

Additionally, American Express implemented a practice that would later become the precursor to interchange fees. Merchants who accepted American Express cards paid the company a percentage of the amount being charged by the customers. This served as an early form of compensation for the credit card issuer and paved the way for the later establishment of interchange fees charged by card networks.

Overall, American Express’ introduction of the first true credit card was a pivotal moment in the history of credit cards, enabling consumers to have greater purchasing power and paving the way for the development of the credit card industry as we know it today.

The Emergence of the Credit Card Industry

The emergence of the credit card industry can be traced back to a growing trend in consumer behavior. As people’s spending habits changed, there was a shift away from cash transactions and a desire for more convenient ways to make purchases. This led to the rise of the credit card trend.

Recognizing this shift, banks saw an opportunity to tap into this emerging market. They started issuing their own credit cards, offering consumers a new way to pay for purchases. These credit cards provided customers with the convenience of making purchases on credit, rather than having to pay in full at the time of purchase.

One of the key features of these credit cards was the introduction of revolving credit. Instead of requiring payment in full each month, customers were now allowed to carry balances over from one month to the next. This was a significant shift that gave consumers more flexibility in managing their finances.

The ability to roll over balances also opened up a new revenue stream for banks. With interest charges applied to unpaid balances, banks began to profit from the credit card industry. This shift from requiring payment in full to allowing balances to roll over was a major turning point in the history of credit cards, leading to widespread adoption and the establishment of the modern credit card industry.

Modern Credit Card Technology

The evolution of credit cards has not only revolutionized the way we make payments but also the technology behind them. In the mid-20th century, credit cards advanced from the original charge plates and cardboard cards to the introduction of the magnetic strip. This revolutionary technology allowed for easier and more secure transactions, as card information could be quickly and accurately scanned at point-of-sale terminals. As the years went by, further technological advancements led to the development of contactless payments, where a simple tap of the card or phone can complete a transaction. Today, we have seen an even more significant shift towards virtual credit cards, allowing users to make purchases online without the need for a physical card. With the rise of mobile payment solutions, such as Apple Pay and Google Pay, consumers can now use their smartphones to make purchases at various merchants. As technology continues to advance, the credit card industry is continually exploring new innovations to enhance security, convenience, and efficiency for consumers.

Physical Cards Become More Commonplace

In the late 1950s, a significant shift occurred in the world of consumer finance as physical credit cards started to gain prevalence. This development revolutionized the way people transacted and carried out their financial dealings. American Express, along with several other credit card companies, played a crucial role in popularizing the use of plastic credit cards.

The introduction of plastic credit cards by American Express and other companies offered a more durable alternative to the previously used charge plates made of metal or cardboard. This shift to plastic cards opened up a range of possibilities for the credit card industry. However, it wasn’t until 1969 when the game-changing invention of the magnetic strip on credit cards made using physical cards even more convenient and secure.

The adoption of physical cards became much more common due to their convenience and added security. This shift in how people carried out transactions also saw Bank of America stepping up its efforts to promote the usage of credit cards. They initiated a mass-mailing campaign targeting millions of potential customers.

The introduction of plastic credit cards and the subsequent invention of the magnetic strip laid the foundation for the modern credit card industry. By offering a physical card that could safely and conveniently store data, financial institutions and consumers alike embraced this new technology. With time, the use of physical credit cards would become a standard practice, providing consumers with a versatile and widely accepted financial instrument.

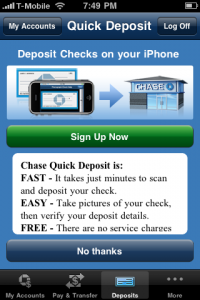

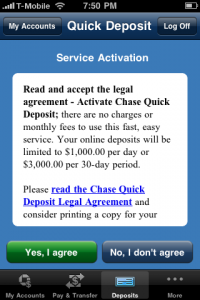

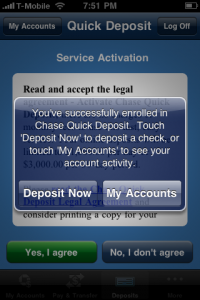

Contactless Payments Become Available

In recent years, a new form of payment has emerged, revolutionizing how transactions are conducted: contactless payments. This technology allows consumers to make touch-free credit card payments, simply by tapping their credit cards on a payment terminal. With the increasing popularity of contactless payments, this trend has been further accelerated by the COVID-19 pandemic.

One of the key reasons why contactless payments have become so popular is their speed and convenience. Gone are the days of inserting a card into a machine or fumbling for cash. Contactless payments offer a seamless and efficient way to complete transactions quickly, making them ideal for busy individuals on the go.

In addition to speed, contactless payments also provide an added layer of security. The technology uses advanced encryption and tokenization techniques, ensuring that cardholder information is protected. Customers can also enjoy the peace of mind that comes with not handing over their physical cards to cashiers, reducing the risk of card fraud or skimming.

Furthermore, the shift towards mobile payments has further fueled the popularity of contactless transactions. Consumers can now use their smartphones as a virtual credit card, making payments even more convenient. With the adoption of EMV cards, which include a chip for additional security, contactless payments have become a preferred method for many.

Overall, contactless payments have revolutionized the way transactions are conducted. With their speed, security, and the growing trend of using smartphones for payments, contactless payments have become a convenient and popular choice for consumers worldwide.

Virtual/Digital Cards Enter the Market

Virtual or digital cards have become an increasingly popular payment option in recent years, thanks to the expansion of mobile and contactless payment technologies. Services like Apple Pay, Google Pay, and Samsung Pay have revolutionized the way people make transactions, allowing them to use their smartphones as virtual credit or debit cards.

These digital cards are essentially cloud-hosted virtual representations of physical payment or identification cards. Users can securely store their card information on their mobile devices and make payments by simply tapping their phones or smartwatches on contactless payment terminals.

The idea of using a virtual card can be traced back to the 1950s when Frank McNamara and Ralph Schneider created the first credit card, known as the “Diner’s Club.” Initially made of cardboard, this innovative concept allowed individuals to use a single card for multiple purchases at various establishments. Eventually, the Diner’s Club card expanded to international use, laying the foundation for the modern credit card industry.

With the rise of digital technology and the increasing demand for convenience and security in payment methods, virtual cards have entered the market as a convenient and secure alternative to traditional physical cards. By leveraging mobile and contactless payment options, these digital cards provide users with a seamless and efficient way to make transactions in-store, online, or through various mobile apps.

In conclusion, the expansion of mobile and contactless payment options has paved the way for virtual or digital cards to enter the market. These cloud-hosted virtual representations of physical cards offer a convenient and secure alternative for consumers, making transactions easier and more efficient. The legacy of the Diner’s Club as the first credit card serves as a testament to the ongoing evolution and innovation in the payment industry.